-

A. Rs -16,602

-

B. Rs 13,660

-

C. Rs 50000

-

D. Rs 7273

Explanation

-

A. Net Present Value

-

B. New Project Valuation

-

C. Net Profit Value

-

D. Non-Performing Venture

Explanation

NPV stands for Net present value

It is used in capital budgeting and investment planning

-

A. Loss

-

B. Profitability

-

C. Liquidity

-

D. Break-even

Explanation

NPV is a financial metric

It is used to assess the value and profitability of an investment.

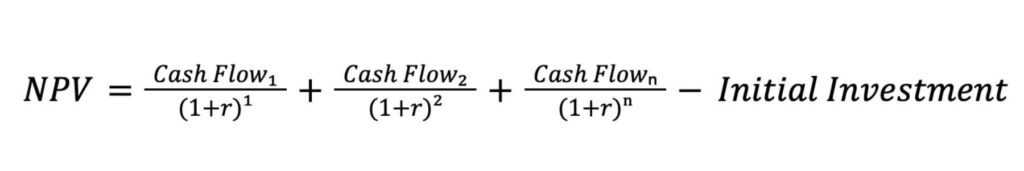

It is calculated by:

subtracting the initial investment cost from the present value of expected cash inflows.

-

A. To estimate risk

-

B. To evaluate market share

-

C. To assess profitability

-

D. To determine liquidity

Explanation

The primary purpose of calculating the NPV of an investment is to assess its profitability.

Net Present Value stands for NPV

It helps in making informed investment decisions

-

A. Rs 1,500

-

B. Rs 1,000

-

C. None of these

-

D. Rs 2,000

Explanation

To calculate the NPV, we use the formula:

NPV = Initial Investment + (Cash Inflows / (1 + Discount Rate)^Year) - (Initial Investment)

✅ Correct: 0 |

❌ Wrong: 0 |

📊 Total Attempted: 0

iamge