Investment Profitability | MCQs

-

A. COGS

-

B. NPV

-

C. ROI

-

D. IRR

Explanation

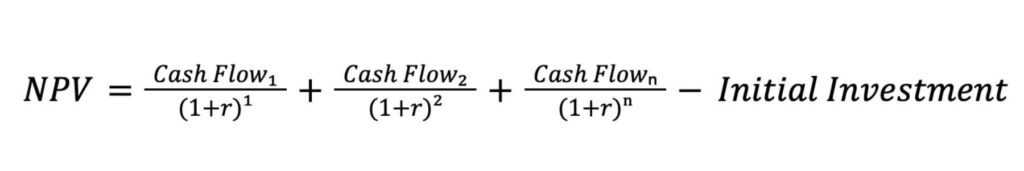

NPV is the difference between the present value of cash inflows and cash outflows over a period of time.

NPV stands for Net present value

It is used in capital budgeting and investment planning

formula:

NPV = Cash Inflow Year 1 / (1 + Discount Rate)^1 + Cash Inflow Year 2 / (1 + Discount Rate)^2 + ... + Cash Inflow Year n / (1 + Discount Rate)^n - Initial Investment

✅ Correct: 0 |

❌ Wrong: 0 |

📊 Total Attempted: 0

iamge